swap in forex means

If playback doesnt begin shortly try restarting your device. In finance a foreign exchange swap forex swap or FX swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates normally spot.

There are two types of swaps.

. Ad Were all about helping you get more from your money. An FX swap or currency swap involves two simultaneous currency purchases one on the spot rate and the other through a forward contract. The difference between the interest rates of two.

It is the interest that a trader earns or pays for holding a trade or. Long swaps these are used when you. Swaps in Forex play an important yet confusing role.

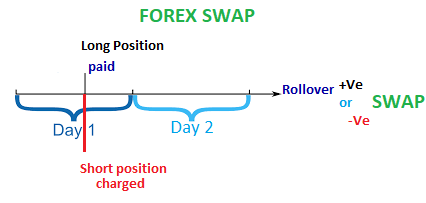

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. In this definition swap is the interest that a trader pays or earns at the time of the rollover. When you trade on margin using leverage and hold a position.

What is a swap in Forex. Basically a swap is the interest rate differential. Whether a trader receives or has to pay a swap depends on the interest rates of the individual.

What is Swap in Forex. A similar swap is also charged on Contracts For Difference. Find Out How Edward Jones Can Assist in Reaching Your Goals.

The swap agreement always says what is. Swap long used for keeping long positions open. What is the meaning of swap in forex trading.

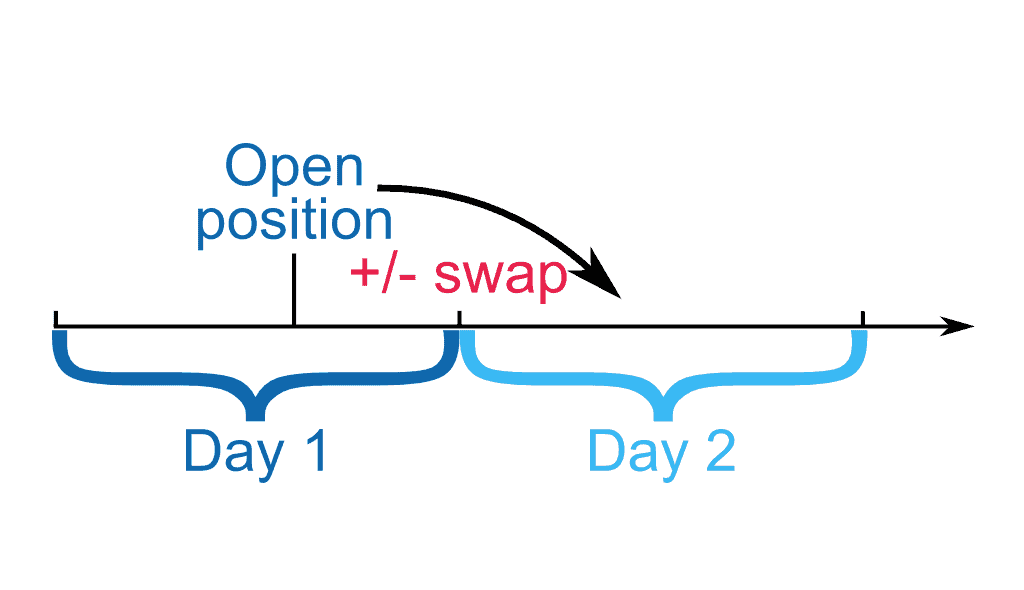

The forex swap meaning implies money movement that is either paid or withdrawn from a trader for keeping positions open for an overnight period. Lets get started today. How to Calculate Swap.

A variety of market participants such as. Swap charges are also referred as rollover fees. A swap in forex is an interest charge for holding an open position overnight.

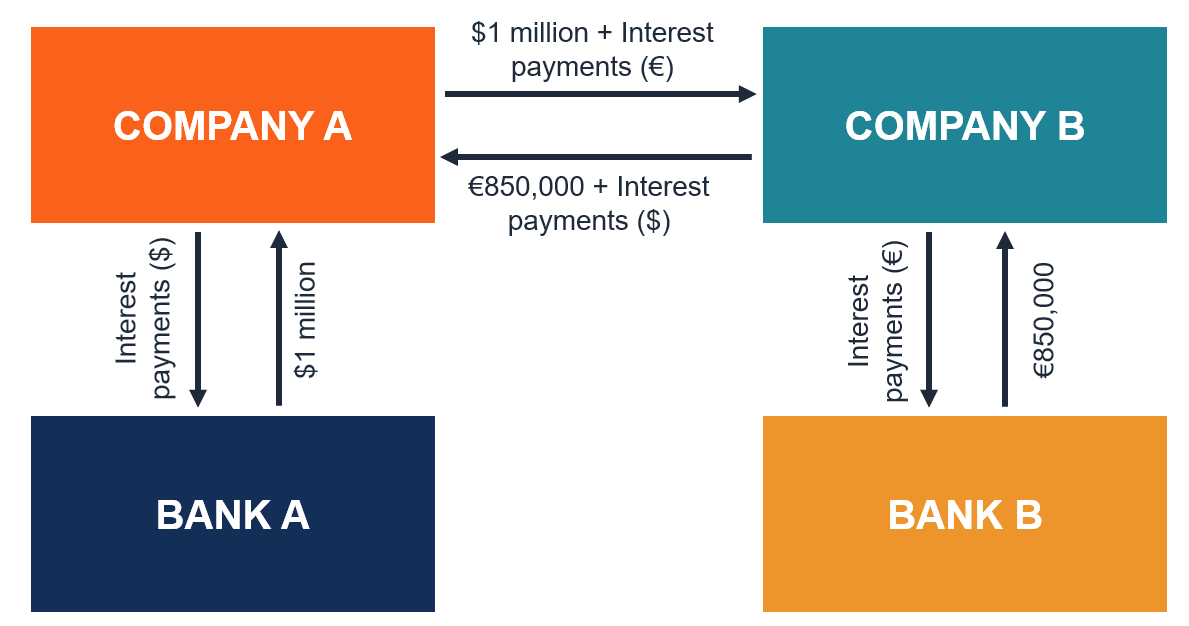

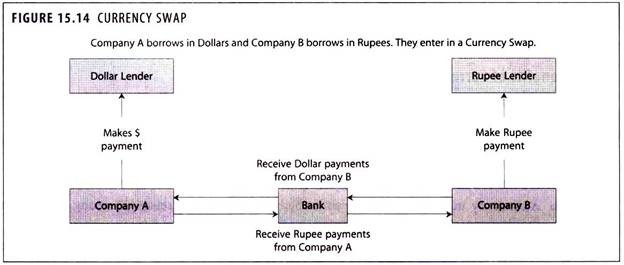

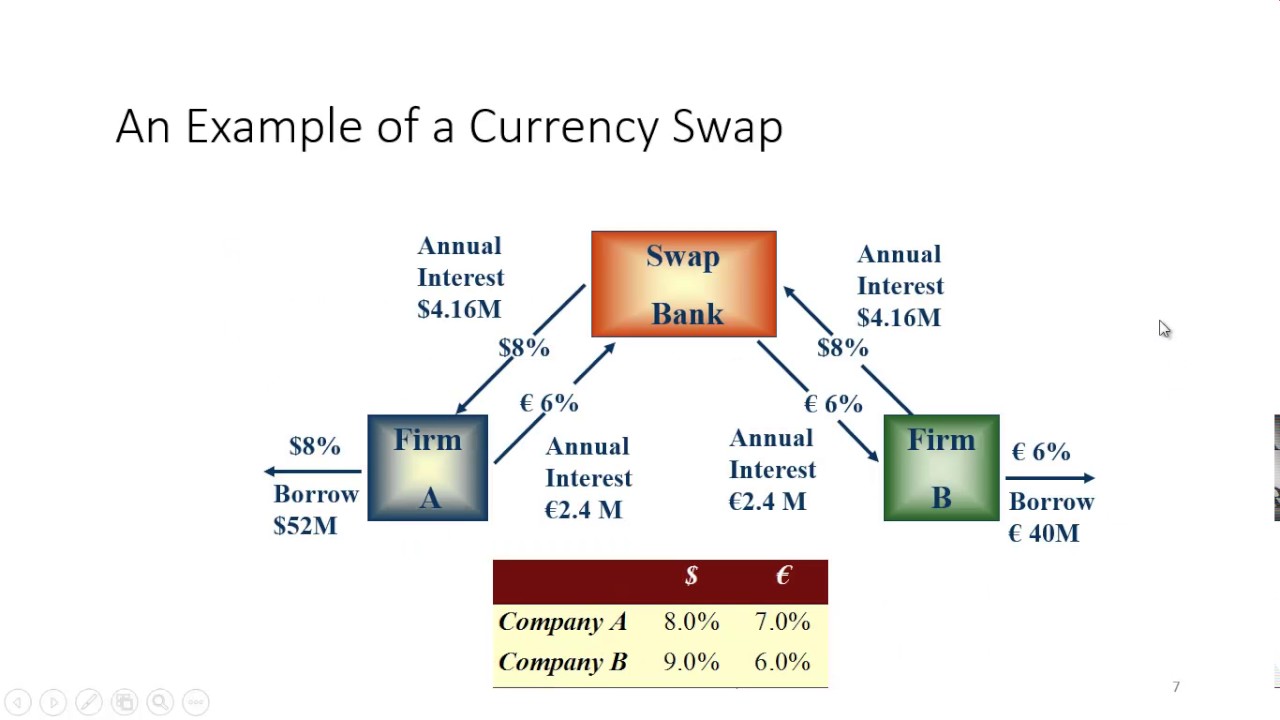

A foreign currency swap is an agreement to exchange currency between two foreign parties often employed to obtain loans at more favorable interest rates. What is swap in forex trading. Swap in forex trading is simply the interest rate that is either paid or charged to you at the end of each trading day.

Swap in forex is an agreement about the exchange of currencies at the start and reversal exchange at the end of the contract. So a swap in forex trading is the interest that you pay or receive for keeping an open trade overnight. A swap which is also known as the rollover fee is the cost you need to pay if you keep a position open overnight.

A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight. A swap is the interest rate differential between the two currencies of the pair you are trading. It is calculated according to whether your position is long or short.

The most important thing is. A currency swap is a foreign exchange transaction that involves trading principal and interest in one currency for the same in another currency. Part of the reason is that the word is used to refer to two different things.

The term swap comes up from time to time in the world of trading and can cause confusion. The Forex swap or Forex rollover is a type of interest charged on positions held overnight on the Forex market. These swaps come in two forms.

A Swap in Forex is an interest payment that you either settle or collect for carrying positions overnight into the following day. In simple words swap is a special operation that carries an open position in a trading instrument overnight for which the difference in interest. Swap also known as Rollover Overnight Funding or Overnight Interest refers to the interest income or expense generated by an overnight position in forex trading as part of daily.

In Forex trading the interest rate paid or received by a trader is called a swap. It means that all the deals are made with the actual delivery of the currency the next workday after their execution. A swap on Forex is an operation of money depositing or withdrawal for moving an open position to the next day.

Forex swap is not actually a physical swap. When you trade forex you express a view on the direction of a currency pair by buying or selling the base currency first-named currency with profit or loss made in the quote currency. Transactions on the Forex market are made on Spot terms.

Ad Edward Jones Offers Personal Time Comprehensive Solutions. Swap As An Interest Fee In Forex. When trading Forex or other CFD Contract for Difference financial instruments swap also known as rollover refers to the interest paid or received for keeping a position.

Instead a swap in Forex is an interest fee which needs to either be paid in or will be charged added to. On Forex a marginal system of trading is used which allows.

What Is Swap In Forex A Beginner S Guide Tradefx

Currency Swap Quantra By Quantinsti

Swap Definition Forexpedia By Babypips Com

What Are Swaps In Forex Forex Academy

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

Currency Swap Vs Interest Rate Swap

What Are Swaps In Forex Forex Academy

What Is Forex Swap Finlogic Net Forex News Swap

Currency Swap Contract Definition How It Works Types

What Is The Meaning Of Swap In Forex Trading

Secrets Behind Forex Swap Complete Guide Freeforexcoach Com

What Is The Meaning Of Swap In Forex Trading

What Is Swap In Forex Trading With Examples

Currency Swap Meaning And Benefits Foreign Exchange Financial Management

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)